Written by Scott Matusow, Mr.Matusow holds a position in the company featured in this article.

Last week, Cubist Pharmaceuticals Inc. (CBST) agreed to buy Trius Therapeutics Inc. (TSRX) and Optimer Pharmaceuticals Inc. (OPTR) for as much as $1.62 billion. Cubist agreed to merge with Trius for $13.50 a share or about $707 million in cash; however, many believe other bidders will step in with a higher bid, and/or Cubist will be forced to raise its bid to over $15. It seems to us that Cubist will need to up the ante here, and Trius needs to consider its legal fiduciary duties to its shareholders, or face additional litigation, like the lawsuit filed yesterday. Also, many Optimer shareholders are not satisfied with the offer Cubist made for their company, as evident by another lawsuit filed by an Optimer shareholder.

If any of these deals fall through, we feel Tetraphase (TTPH), who develops various antibiotics for the treatment of serious and life-threatening multi-drug resistant infections, could benefit greatly.

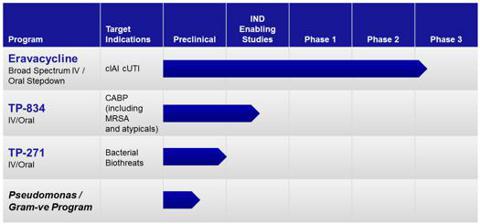

Tetraphase Pipeline:

Lead Product: Eravacycline (TP-434)

Eravacycline is the company's lead product candidate currently in Phase III clinical trials. Eravacycline is an intravenous and oral antibiotic for use as a first-line empiric monotherapy for the treatment of multi-drug resistant (MDR) infections, including MDR Gram-negative bacteria.

Trius's tedizolid phosphate (TR-701) is designed to treat patients with acute bacterial skin and skin structure infections or complicated skin and skin structure infections, and is defined as a gram-positive bacteria treatment, whereas eravacycline is defined as gram-negative.

Gram positive bacteria retains the original bacterial stain because it has a very thick convoluted cell membrane. Gram negative bacteria cell membranes are not nearly so thick or convoluted as Gram positive, so they tend be not as resistant. Cubist, along with companies like Pfizer (PFE), might be very interested in Tetraphase's solution here, especially in lieu of its current market cap that is under $200M. Comparatively, Trius sold for a deal valued at over $800M.

Pfizer, along with several other larger pharmas, have expressed interest in adding anti-bacterial drugs to their existing profiles, especially considering that many of their anti-bacterial drugs are due to come off of patent soon.

Pfizer's anti-bacterial drug Zyvox is due to lose its patent protection in 2014. It makes sense that Pfizer, Cubist, and others in this market segment are looking to re-up their future protected revenue streams, and that is what we are hearing -- that more acquisitions are to come.

With the Generating Antibiotic Incentives Now (GAIN) Act "gaining" traction, we expect small cap developmental antibiotic companies to have even large "bullseyes" stamped on them by larger pharmas.

Under the GAIN Act, sponsors filing a NDA would be issued 5 years of market exclusivity in addition to the standard 5 years of exclusivity for a new chemical entity (NCE). Therefore, Tetraphase could qualify for 10 years of market exclusivity, making it an even more attractive take-over target.

Big Pharma certainly likes exclusivity, so again, we do expect more of these antibiotic companies to be acquired. We believe the opportunity for both traders and investors is strong here, and opportunity is what we all are looking for in the market!

What is important here is that Tetraphase recently completed a successful Phase II clinical trial of eravacycline with intravenous administration for the treatment of patients with complicated intra-abdominal infections (cIAI). This is important because Tetraphase is further along than most companies with similar developmental drugs with double the market cap, like Trius was with Tedizolid

- Key Differentiating Attributes of Eravacycline

The following key attributes of eravacycline, observed in clinical trials and preclinical studies of eravacycline, differentiate eravacycline from other antibiotics targeting multi-drug resistant infections, including multi-drug resistant Gram-negative infections. These attributes should make eravacycline a safe and effective treatment for cIAI, cUTI and other serious and life-threatening infections for which we may develop, such as ABSSSI and acute bacterial pneumonias.

Even if Tetraphase is not acquired, which as stated, we believe they will be, the company might be worth a strong look from biotech investors based on its current valuation of under $200M for the reasons we mention above.

Investors should be aware of the potential opportunity here, but as all small cap biotechs go, there is always substantial risk with investing in them. However, Tetraphase is well financed and has an abundant of cash on hand to last for years at its current burn rate.

| Balance Sheet | |

| Total Cash (mrq): | 78.16M |

| Total Cash Per Share (mrq): | 3.78 |

| Total Debt (mrq): | 13.79M |

| Total Debt/Equity (mrq): | 22.02 |

| Current Ratio (mrq): | 8.83 |

| Book Value Per Share (mrq): | 3.15 |

The company burns a little over $3M a quarter, providing itself plenty of liquidity moving forward into the next 20 quarters, so dilutive raises are not very likely here.

| Shares Outstanding: | 20.67M |

| Float: | 7.95M |

| % Held by Insiders: | 27.27% |

| % Held by Institutions: | 13.10% |

Insiders actually own more shares than the stats show. It's a good sign to see insiders bullish on their own company.

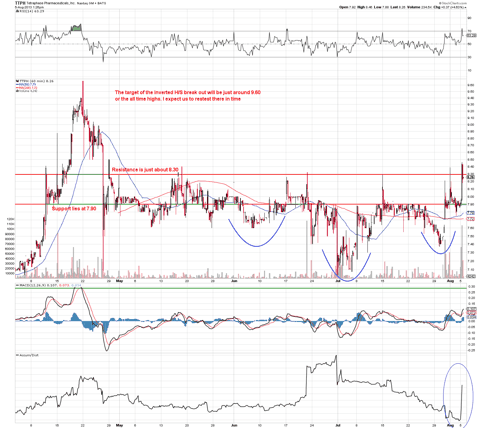

Chart:

Tetraphase has been consolidating around the $7.90 level for quite some time, forming a good support range there. In the past couple months it has formed an inverted head and shoulders with a neckline at $8.30 a share. The $8.30 price point should act as the breakout point on strong volume. If it clears this range, the measured move is estimated to reach $9.60, but the stock will most likely see some minor resistance around $9,as IPO buyers take profits.

Conclusion:

Tetraphase is a strong speculative investment, considering the GAIN act and the recent acquisition of Trius for 5x the current market cap of Tetraphase. We feel it's a good chance Tetraphase could be acquired for a price around $12 to $14 a share, based on that market cap of $170.54M

Disclosure: long TTPH.

Additional disclosure: Disclaimer: This article is intended for informational and entertainment use only, and should not be construed as professional investment advice. They are my opinions only. Trading stocks is risky -- always be sure to know and understand your risk tolerance. You can incur substantial financial losses in any trade or investment. Always do your own due diligence before buying and selling any stock, and/or consult with a licensed financial adviser.