With some added confidence shown by investors yesterday, it's a good time to look at some "risk on" small cap bio-pharma stocks that I feel offer good upside for both swing trades and longer term holds. However, with the looming "fiscal cliff" approaching, without a clear agreement in Washington between both political parties soon, the market might still see some additional selling pressure.

BG Medicine (BGMD)

BG Medicine engages in the discovery, development, and commercialization of novel cardiovascular diagnostics to address unmet medical needs. The company markets the BGM Galectin-3, a diagnostic test for measuring galectin-3 levels in blood plasma or serum for use in patients with heart failure. These are sold to hospitals and clinics in the United States, as well as through distributors in certain countries in Europe. It is also developing CardioSCORE, a cardiovascular diagnostic test designed to identify individuals at high risk for near term cardiovascular events, such as heart attack and stroke; and galectin-3 test for a second indication to identify individuals at risk for developing heart failure, such as patients who have suffered a heart attack, as well as patients suffering from hypertension or diabetes. It has strategic collaborations with Abbott Laboratories (ABT) to develop and commercialize galectin-3 assay kits and related control kits and calibrators.

In the earnings press release dated November 13, 2012, BG Medicine, Inc. announced financial results for the fiscal quarter ended September 30, 2012 and provided a business update.

Included in this business update, the company announced a new commercial strategy to speed the adoption of its cardiovascular diagnostic tests - the BGM Galectin-3 test and the CardioSCORE test.

In the release, the company announced a strategic reorganization in its research and development department moving toward a more commercially-oriented role in support of studies designed to further differentiate and support the BGM Galectin-3 and CardioSCORE tests in the marketplace. As a result of this strategic reorganization, eleven positions in early discovery research were eliminated on November 8, 2012. As a result of the strategic reorganization, the company will record one-time severance costs of approximately $150,000, which will be recorded in the fourth quarter of 2012. Further, the company estimates that it will generate savings of up to $1.2 million in 2013. After this strategic reorganization, the company will have 26 full time employees.

President and CEO of BG Medicine Eric Bouvier remarked;

We have taken a series of important steps over the past year to realign BG Medicine into a more commercially-focused company, capable of playing a larger role in facilitating the market adoption of our innovative cardiovascular diagnostic tests. The steps outlined today represent the culmination of our efforts to transform BG Medicine. Taken together, these actions place us in a much stronger position to control our own destiny and drive our own commercial success.

In July 2012, BD Medical announced the filing of a 510(k) Pre-market Notification with the U.S. Food and Drug Administration (FDA) for regulatory clearance of the Abbott Architect galectin-3 assay, which is used with Abbott's fully automated Architect immunochemistry instrument platform. In August 2012, Abbott received a letter from the FDA regarding its 510(k) notification that requested additional information and Abbott is undertaking activities to respond to the FDA. In addition, BD Medical expects Abbott to begin marketing an automated version of the test in the EU under a CE Mark in late 2012 or early 2013. In May 2012, a 510(k) was submitted by the company to extend the labeling indication for the BGM Galectin-3 test to include individuals in the general adult population who are at risk for developing heart failure based on elevated levels of galectin-3. In July 2012, a letter from the FDA regarding the 510(k) notification requested additional information, including information regarding the clinical validation study and additional analytical study data. A response was submitted to the FDA in November 2012. If BD Medical obtains clearance in the United States for this additional indication, the company expects the potential market for the BGM Galectin-3 test to increase significantly.

On November 15th, company officer Bancel Stephane purchased 100,000 shares for approximately $126,000. Obviously, this is a bullish sign when an insider buys a block this large with their own money. Tackling some of the cost issues the company has as BG is looking to do, is clearly a step forward.

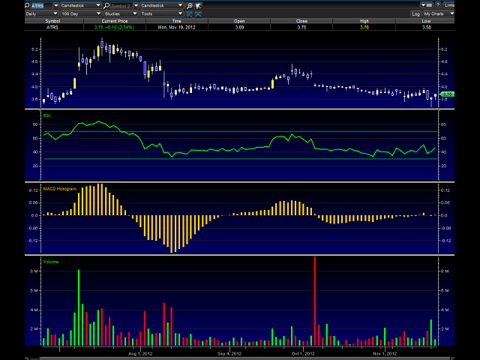

The chart above shows a very oversold condition, but the stock showed signs of turning around yesterday as the volume and stock price moved up. The RSI is finally starting to turn up along with the MACD, so it looks to me we have seen a bottom here, so I consider this a nice pinch chart bottom bounce trade -- at the very least.

With a current market cap of $23.58M, a strong partnership with Abott Labs, and speculative longer term value, BG Medicine seems ridiculously undervalued and oversold to me. My short target opinion (1 day to 3 months) is between $1.45- $1.55 a share. My long term target opinion here is not certain at this time -- not until we see how the company executes its new business plan.

Arena Pharmaceuticals (ARNA)

Arena engages in discovering, developing, and commercializing oral drugs that target G protein-coupled receptors in the therapeutic areas of cardiovascular, central nervous system, inflammatory, and metabolic diseases.

Since the approval of its weight loss drug Belviq in June the stock has fallen from a yearly high of $11.39 to $7.21--a fall of 37%. I feel long term investors have excellent value here at its current price level. The focus now on Arena should be the potential top-line growth from its strong pre-clinical pipeline. Because Arena will likely receive a large amount of cash from Belviq sales, I believe it is a strong speculation bet that management will re-invest this cash into its pipeline, gaining leverage in any potential deal with a large pharma partner for any of its pre-clinical pipelined drugs.

Arena had some interesting things to say about its long term goals in its presentation at the Lazard Capital conference:

[We have a] significant market opportunity, [for Belviq] worldwide it's 0.5 billion individuals that are classified as obese. So it's a significant market opportunity for us. We actually are very much ready for the launch. We've delivered we announced in our last 10-Q launch supply to Eisai. So we delivered uh $11.6 million worth. It's a portion of the launch supply. So we'll be ready to launch as soon as we get DEA scheduling.

So in terms of looking at further down the economics at $250 million in net sales, we'll get 31.5% of that [from its partner Eisai] which is about $80 million plus that threshold we achieved some purchase price adjustments as well as some milestones which another $55 million take on top of that when we get DEA scheduling is another $65 million. So if I do my math right that's an excess of $200 million on their first $250 million of sale.

So it makes significant opportunity for us. In terms of other opportunities we just announced last week a nice collaboration with the South Korean company Ildong but we received a $5 million upfront payment great economic service as well first dollar on net sales is at 35% and that will ramps up to 45% on net sale.

In terms of other areas that we are moving forward with the European strategy. We did file in the EU in March of this year. I can't believe it's for this year but and so we founded the 120 day questions and we are hopeful to get a decision on that in first half of 2013 probably behind that is actually Switzerland as well which is where our manufacturing facility is.

The chart above shows me a nice symmetrical triangle setting up for Arena. The MACD and RSI indicate that this new leg up still has a lot of steam left to go higher.

The catalyst trading is pretty much done in Arena, so the stock has been seeing a steady decline--hot money exiting, smart money accumulating. Although still speculative, Arena might just be a great long term investment if it manages its money correctly. Belviq sales could open the door for Arena to potentially become a full fledged pharma within the next 3 to 5 years. I believe the stock price could reach near $20 or so in the next 2 years - if again, managed correctly.

My short term (1 day to 3 months) target opinion for Arena is $10. My long term target opinion is $30 dollars -- 3 years.

Antares Pharma (ATRS)

Antares engages in the development and marketing of self-injection pharmaceutical products and technologies, and topical gel-based products. It offers Vision/Tjet reusable needle-free injectors that deliver precise medication doses through high-speed pressurized liquid penetration of the skin without a needle; The Vibex disposable pressure assisted auto injector devices that are used for the controlled pressure delivery of drugs into the body utilizing a spring power source; disposable pen injection systems, which are needle-based devices designed to deliver multiple drugs by injection through needles from multi-dose drug cartridges.

Antares expects to file an NDA for Vibex MTX in February of 2013, but I believe the NDA filing to be as early as December of this year, based on the company's prior history of under-promising and over-delivering.

The company recently announced positive results from an open-label, randomized, crossover study comparing the systemic availability of MTX Medi-Jet to oral methotrexate (MTX) in adult patients with rheumatoid arthritis (RA).

This study was designed to compare the relative systemic availability of MTX following oral administration to subcutaneous (SC) self-administered MTX using the Medi-Jet device. Patients were assigned to one of four dose levels of MTX, 10 mg, 15 mg, 20 mg, and 25 mg. Results showed that the systemic availability of methotrexate following oral dosing plateaus above 15 mg. Following administration of MTX with Medi-Jet, the systemic availability increased proportionally at every dose, which will extend the range of exposure compared to patients receiving oral therapy.

Historically, parenteral MTX use has been limited in clinical practice for several reasons including the inconvenience of weekly injections by a healthcare professional, and/or the challenges associated with teaching patients with impaired hand function, safe and sterile self-injection techniques. To address these issues, the easy to use, single-use MTX Medi-Jet auto injector was developed to optimize the clinical benefit of MTX, leading to cost effective treatment outcomes.

VIBEX QS T for Testosterone Replacement Therapy:

QS T is potentially the first self-injectable testosterone product for men suffering from symptomatic testosterone deficiency (Low T). Most of this market currently is made up of gel treatments, which most men really do not like. I am sure many of you have seen the commercials on TV advertising these testosterone gels.

Rx's for current treatment options equal two-thirds topical gel testosterone and one third intramuscular injections, and according to recent reports, U.S. sales of testosterone replacement therapies exceeded $1.6 billion* in 2011- 5.6 million Rx's. Studies have shown that gel patients do not achieve adequate absorption or therapeutic response; injection patients bear the cost and inconvenience of in-office injections every 2 to 4 weeks.

- Physicians surveyed believe self-injection will improve patient compliance and deliver sufficient serum testosterone levels--according to the company.

- The New VIBEX QS is particularly well-suited for use with highly viscous drugs such as testosterone- Novel spring mechanism - up to a 1 ml capacity - highly compact device.

- This combination drug/device product is in pre-clinical development, expected to go to market in 2015/2016.

In early October of this year, Antares engaged in a secondary offering at $4.00 to fund development of the above mentioned products -- the company raised $47M in total. Antares now has an abundant reserve of over $70M in cash, so I would expect its Q4 2012 earnings call to show a profit from its royalty based revenue it primarily receives from Teva Pharma (TEVA) for Tev-Tropin, Tjet, and reusable hGH -- in which Antares receives strong margins on device sales, and mid-to-high single digit % royalty on overall product sales. Antares has two single shot disposable auto injectors. One is Epinephrine (N.A. rights) and the other is an undisclosed product (U.S rights) in which it receives margins on device sales along with mid to high single digit % royalty on overall product sales.

The chart above indicates to me that Antares has seen a double bottom bounce. The MACD and RSI are trending upwards, and with a little bit more volume, Antares could be seeing the $4 dollar range soon.

In my opinion, investors and traders should look at both short and longer term fundamentals for Antares, especially the longer term ones for the company.

My short term (1 day to 3 months) target opinion for Antares is $4 before the end of the year, and near $5 by February of next year. My long term target opinion is $12 a share -- 3 years.