Trading biophama companies before a catalyst event, if done correctly, can be a very profitable proposition. Some traders and investors who enjoy bringing more risk into play often times will hold through the actual catalyst event. While this does bring more risk into play, the reward from engaging in this can be a massive one. Today, I would like to talk about one such company I feel has strong upcoming catalysts that could drive the stock price higher in the short term.

Anacor Pharmaceuticals (ANAC) is a biopharmaceutical company focused on discovering, developing, and commercializing novel small molecule therapeutics derived from its novel boron chemistry platform. The company has discovered, synthesized, and developed seven product candidates currently in development. Its two lead product candidates are topically administered dermatologic compounds; Tavaborole, a topical antifungal for the treatment of Onychomycosis, and AN2728 a topical anti-inflammatory for the treatment of atopic dermatitis and psoriasis. The company also discovered two compounds that are in development with its partners. One is an animal health product candidate which is licensed to Eli Lilly and Company (LLY). The other, AN5568, is for human African Trypanosomiasis (HAT, or sleeping sickness), which is licensed to Drugs for Neglected Diseases initiative.

The company's lead drug, Tavaborole is a boron-based topical solution currently in Phase III clinical trials. Tavaborole is designed to treat fungal infections of the nails and nail bed (onychomycosis) on a localized basis.

Implementing a novel mode of action, Tavaborole is unique compared to current treatments such as Sanofi's (SNY) Penlac and Novartis's (NVS) Lamisil in that it's designed to greatly minimize the risk of any systemic side effects while achieving similar or greater efficacy.

To offer an idea of the potential market for Tavaborole, Penlac at its peak realized $330M world wide sales, while Lamisil realized $1.2B in peak sales. If Tavaborole ultimately gains FDA approval, the treatment could prove itself a very strong revenue generator for Anac.

Recently, Anacor had its third quarter conference call where the company presented a story worth watching because of its recent highlights and upcoming catalysts. After its stock offering in October, the stock price reacted unfavorably. However, now with sufficient cash to get them through several catalysts, it could be a good time to buy at these levels. Let's take a look at the upcoming events for Anacor.

Upcoming Catalyst events:

Anacor plans to announce top-line data for Tavaborole in January 2013 for the first Phase III trials related to this drug in treating Onychomycosis. Six weeks later, the company expects the second trial results to be publicized for this same indication. Onychomycosis is a fungal infection of the nail and nail bed that affects approximately 35 million people in the United States. The company plans to file an NDA for tavaborole in mid-2013, subject to the results of the phase three trials.

By the end of this year, Anacor plans to announce data from the phase two safety, pharmacokinetics, and efficacy study related to AN2728. AN2728 is a topical anti-inflammatory product candidate for the treatment of dermatitis and psoriasis in adolescents. The company expects to initiate phase two trials in children ages 2-11 shortly after the announcement of these results. Atopic dermatitis is a chronic rash characterized by inflammation and itching and affects an estimated 10% to 20% of infants and young children. Psoriasis is a chronic inflammatory skin disease that affects approximately 7.5 million people in the United States and over 100 million people worldwide. The ongoing studies with AN2728 include the following:

- An open-label study of the safety, pharmacokinetics (PK) and efficacy of AN2728 2% ointment when applied twice-daily for up to 28 days. The primary outcome measure will be an assessment of safety and tolerability. Secondary outcome measures will include a PK profile and achievement of treatment success.

- A randomized, double-blind, bilateral dose-ranging study of AN2728 2% and 0.5% ointments applied once-daily or twice-daily for up to 29 days. The purpose of this trial is to determine the optimal dosing concentration and frequency for phase three studies. Secondary outcome measures will include an assessment of safety and tolerability.

Dependent on positive phase two trials, the company expects to initiate a phase three trial in atopic dermatitis in mid-2013.

Also during the third quarter conference call, Anacor referred to its cash position and spoke about the offering of stock I wrote about earlier. The company believes that its existing cash, cash equivalents and short-term investments totaling approximately $36.6 million as of September 30, 2012 and the net proceeds of approximately $22.7 million from the October 2012 sale of 4,000,000 shares of the company's common stock will be sufficient to meet its anticipated operating requirements until it files its NDA for Tavaborole in Onychomycosis. This is currently expected to occur in the middle of next year. If necessary, the company would make appropriate adjustments to its spending plan in order to ensure sufficient capital resources to complete this filing.

Anac will also be participating in the Piper Jaffray 24th Annual Healthcare Conference on Wednesday, November 28, 2012 at 11:30 a.m. ET in New York, New York. Often times after a company presents at a large investor conference, the stock price receives a boost so I consider this a small catalyst event that should add to the short term upside potential of the stock.

Anacor projects cash, cash equivalents,and short-term investments to be at least $45.0 million at year-end 2012, which the company believes will be sufficient to meet the anticipated operating requirements until the New Drug Application (NDA) for Tavaborole is filed.

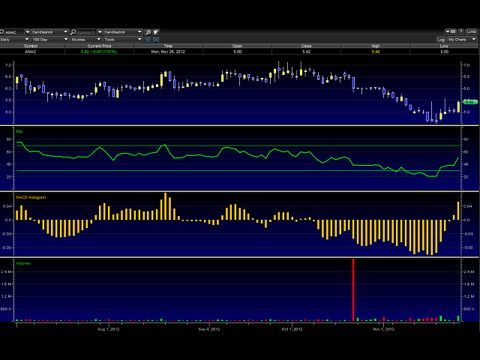

From the chart above, Anac has begun to trade upwards in advanced of the catalyst events mentioned here. The Relative Strength Index (RSI) is turning bullish again and volume is also picking up. The MACD Histogram also indicates this. During the recent run, we can see higher highs and high lows displayed. It's my opinion a short term price target of $6 is on the horizon.

| Share Statistics: | |

| Avg Vol (3 month): | 110,415 |

| Avg Vol (10 day): | 128,057 |

| Shares Outstanding: | 35.57M |

| Float: | 23.78M |

| % Held by Insiders: | 36.49% |

| % Held by Institutions: | 68.90% |

- Short Positions (10/31/2012) 431,065 Shares

- Change from Last -13.04%

- Percent of Float 2.06%

Anac's current price is $5.40 a share with a market cap of $192.07M.

Mike Havrilla a well respected biotech trader, is also is bullish on Anac according to his recent Seeking Alpha write-up on the company;

Given the near-term timeline for Phase III results in January and the relatively low-risk nature of the Phase II results this quarter (i.e. the study is designed to assess safety and PK parameters); Anacor is poised to rebound back toward the moving averages and the recent stock offering price of $6/share. Finally, I estimate a high probability for success (i.e. 80%) in the Phase III clinical trials for Tavaborole vs. placebo based on the results of previously conducted Phase 2 clinical trials and an objective endpoint of eradicating nail fungal infections that is not subject to placebo effect or subjective bias.

I agree with Mike's assessment 100% as stated above, and it's also my opinion the stock should see a move to around $6 soon. Depending on stock market conditions next year and positive results for Anac's trials, a stock price over $10 a share is not out of the question.

Disclaimer: This article is intended for informational and entertainment use only, and should not be construed as professional investment advice. They are my opinions only. Trading stocks is risky -- always be sure to know and understand your risk tolerance. You can incur substantial financial losses in any trade or investment. Always do your own due diligence before buying and selling any stock, and/or consult with a licensed financial adviser.