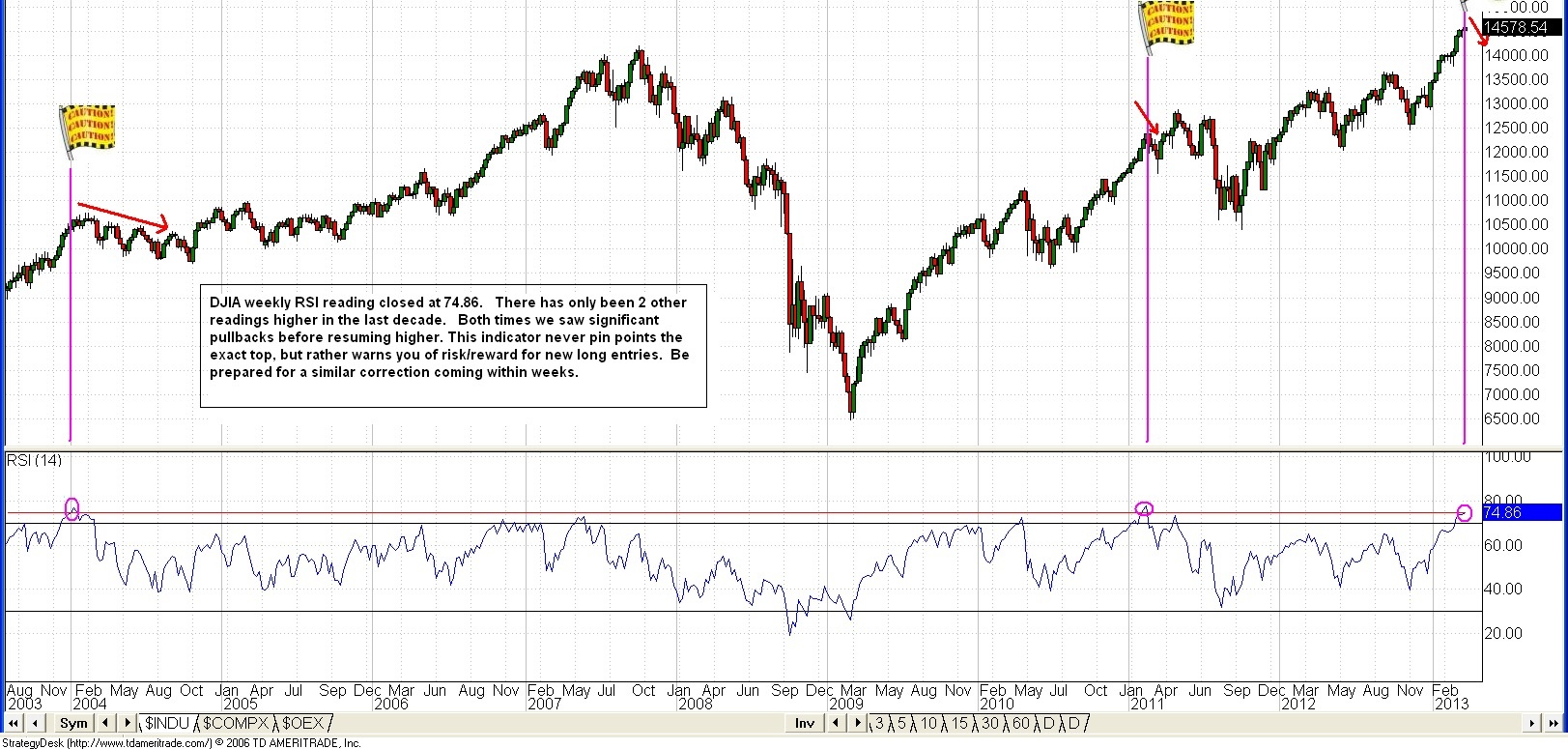

Above, we can see an historical chart of The Dow going back to 2003. Take note of the current market trend and compare to past trends. I feel the market needs a correction and is over extended on the QE "drug," with economic fundamentals that do not support the current "bull market." I feel this year will be different in that we will not close this year higher than where it started, which would be an historical first (8% first Q gain or higher). I would note that the variable that I believe will change this is the historical fact that we have never had such high unemployment with low "real" economic investment coupled with an inflated up trending market. I strongly feel that banks are over levering the stock market using "QE" liquidity for high frequency trading, while remaining at a 5 year low loaning money for "real world" investment - this could lead to a nasty down turn.

Above, we can see an historical chart of The Dow going back to 2003. Take note of the current market trend and compare to past trends. I feel the market needs a correction and is over extended on the QE "drug," with economic fundamentals that do not support the current "bull market." I feel this year will be different in that we will not close this year higher than where it started, which would be an historical first (8% first Q gain or higher). I would note that the variable that I believe will change this is the historical fact that we have never had such high unemployment with low "real" economic investment coupled with an inflated up trending market. I strongly feel that banks are over levering the stock market using "QE" liquidity for high frequency trading, while remaining at a 5 year low loaning money for "real world" investment - this could lead to a nasty down turn.

Pumping up stocks do not help the real economy. The average person is still struggling to get by, while more jobs are being shipped over seas, and more people have to make due with less. The current "housing recovery" is nothing of the kind --- The supply has dwindled down due many home owners renting out their vacant homes, along with banks doing the same. The demand for homes has not increased significantly at all, and new initial filings for foreclosures are at a 4 year high. Many of these homes are certain to come on the market, causing home prices to fall again, due to supply outweighing demand - again.

Conclusion: Approach the market with a traders' mentality, not an investor one. Ignore stock brokers pitching you stocks for long term gains. The current system is not sustainable, and if not this year, than next year the global bad economic and fiscal policies will come back and bite us. Google the term "Keynesian Economics" for more information and background to better understand my viewpoint here!

Happy Trading!

Upper left on main page - Site disclaimer applies, please read it, thanks!