Cyclacel Pharmaceuticals (NASDAQ: CYCC) is a development-stage biopharmaceutical company dedicated to the development and commercialization of novel, mechanism-targeted drugs to treat human cancers and other serious diseases. Cyclacel's strategy is to build a diversified biopharmaceutical business focused in hematology and oncology based on a development pipeline of novel drug candidates. Cyclacel's clinical development priorities are focused on sapacitabine, an orally available, cell cycle modulating nucleoside analogue. The oral dose availability is one major differentiator Cyclacel offers with its sapacitabine candidate.

In 2007, Dr. Kantarjiian from the Leukemia Department at the University of Texas's Cancer Center called sapacitabine,

"one of the most exciting drugs in development for AML since cytarabine, the current standard of care."

Today, we will discuss what is on the horizon for Cyclacel and this drug in the short and long term.

Currently, sapacitabine is being evaluated in the SEAMLESS Phase III trial being conducted under a special protocol assessment ((SPA)) agreement with the US Food and Drug Administration for the front-line treatment of acute myeloid leukemia (AML) in the elderly. It is also in Phase II studies for AML, myelodysplastic syndromes, non-small cell lung cancer (NSCLC) and chronic lymphocytic leukemia.

In October of last year at the Hematologic Malignancies Conference, Cyclacel announced impressive data regarding survival of elderly patients in its Phase II trial with intermediate-2 or high-risk myelodysplastic syndromes ((MDS)) after failure of front-line treatment. Per Wikipedia, myelodysplastic syndromes (formerly known as pre-leukemia) are:

"a diverse collection of blood related medical conditions that involve ineffective production of the myeloid class of blood cells."

In Cyclacel's October press conference, the company announced median overall survival to date for the 63 patients in the Phase II study at 252 days or approximately eight months. Median overall survival for 41 out of 63 patients with 10% or more blasts in their bone marrow is 274 days or approximately nine months. This compares to the median survival for patients as defined by the International Prognostic Scoring System (IPSS) at 4.3 to 5.6 months.

SEAMLESS Trial:

In January 11, 2011, the company opened enrollment of the SEAMLESS pivotal Phase III trial for the company's sapacitabine oral capsules as a front-line treatment of elderly patients aged 70 years or older with newly diagnosed AML who are not candidates for intensive induction chemotherapy.

Cyclacel is using decitabine as the active control arm for its trial. Decitabine (Dacogen) is manufactured by Astex Pharma's (ASTX) and was recently approved in Europe but not yet in the U.S.

The most extensive clinical trial data of dacogen in AML is the DACO-016 Phase III study initiated in 2006 and presented at ASCO in 2011. DACO-016 was a randomized open-label Phase III trial of Dacogen versus physician's choice (supportive care or low-dose cytarabine) in elderly patients with newly diagnosed AML with poor- or intermediate-risk cytogenetics.

Cyclacel chose decitabine as an active control arm as it is one of the treatment options recommended by the National Comprehensive Cancer Network's Clinical Practice Guidelines, said Judy Chiao M.D., Cyclacel VP of clinical development and regulatory affairs.

Cyclacel is looking at giving greater hope to older patients diagnosed with acute myeloid leukemia. Considering the current environment demonstrating a six month survival profile, people are not going to see much of a benefit to going through potentially two months of chemotherapy to a short time past that point. Generally, they will just be going home to try and preserve some quality of life in the time they have left.

In a recent presentation at the BIO CEO and Investor Conference, Cyclacel described why it feels sapacitabine can succeed. The drug uses a lower level of intensity which helps the immune system while treating. The company also notes that most elderly are unable to sustain chemotherapy. In fact, in early data from the company's Phase III SEAMLESS trial, safety indicators show a sapacitabine/decitabine combination to have a mortality rate in the first two months of 13% versus 36% for chemotherapy and 20% for decitabine alone.

In the investor conference, the company goes on to say that the oral dose of sapacitabine is well tolerated with multiyear maintenance dosing achieved.

Upcoming Catalysts:

- A SEAMLESS Phase III enrollment update

- NDSMB (Data and Safety Monitoring Board) review of SEAMLESS

- Update on Phase II data in myelodysplastic syndromes after HMA's (Hypomethylating Agent)

- Update on Phase I data for sapacitabine and selleciclib in patients with solid tumors

Last week, Cyclacel announced two important additions to its patent portfolio. Within this announcement, CEO Spiro Rombotis commented:

The grants of the '792 and '790 patents are important enhancements of sapacitabine 's intellectual property estate. They supplement sapacitabine's existing composition of matter, dosing regimen and combination treatment patent protection and support US and EU market exclusivity toward the end of the next decade. We are pursuing a broad intellectual property strategy providing us with a strong foundation to achieve our clinical and commercial objectives for sapacitabine and our other assets. As we continue to enroll SEAMLESS, our pivotal Phase III trial of sapacitabine as front-line treatment in elderly patients with acute myeloid leukemia, we look forward to providing additional updates for sapacitabine this year, including Phase II data in myelodysplastic syndromes, AML preceded by MDS, and solid tumors.

The above statement certainly is positive, and can be expected from any decent management. What is important above is the numerous near term catalyst the company has coming. Also of note is that sapacitabine is being designed as a front line treatment.

Seeking Alpha Contributor Steve Rosenman remarks from his December 2012 article;

As for AML, Cyclacel began the SEAMLESS pivotal Phase III trial for the company's sapacitabine oral capsules as a front-line treatment in early 2011. SEAMLESS is conducted under a Special Protocol Assessment, or SPA, agreement with the FDA. SNSS's drug is not under SPA, nor can it be taken as a front-line treatment.

Steve also goes on to mention something I believe is worth nothing here:

Many have speculated that Celgene may want to mitigate legal risk by simply acquiring or partnering with Cyclacel. This scenario has merit and should not be ignored. The two are basically fighting each other over the rights to use Cyclacel patents. At the end of the day, until proven otherwise, they are valid Cyclacel patents - potentially deserving of royalty.

Cyclacel has a patent infringement lawsuit against Celgene (CELG) which will begin a Markman patent construction hearing on March 16th, 2013. While the final result from this litigation might not be known until the middle of 2014 - the case so far looks favorable for Cyclacel, according to another fellow Seeking Alpha author.

It appears that Celgene might be better served buying Cyclacel out, avoiding litigation all together while retaining a potential billion dollar drug.

| *Institutional Ownership | # of Holders | Shares |

| Total Shares Held: | 26 | 2,214,622 |

| New Positions: | 10 | 1,003,391 |

| Increased Positions: | 12 | 1,009,297 |

| Decreased Positions: | 6 | 146,532 |

| Holders With Activity: | 18 | 1,155,829 |

| Sold Out Positions: | 3 | 48,590 |

As we can see from above, institutions are buying Cyclacel, including Goldman Sachs (GS).

| **Balance Sheet | |

| Total Cash (mrq): | 17.84M |

| Total Cash Per Share (mrq): | 1.91 |

| Total Debt (mrq): | 0.00 |

| Total Debt/Equity (mrq): | N/A |

| Current Ratio (mrq): | 2.73 |

| Book Value Per Share (mrq): | 1.57 |

| Cash Flow Statement | |

| Operating Cash Flow (TTM): | -12.84M |

| Levered Free Cash Flow : | -7.96M |

Cyclacel has over 2 years of operating cash on hand, burning about $2M a quarter, so a cash raise/dilution should not be something that is likely here in the short term.

| Share Statistics | |

| Avg Vol (3 month)3: | 290,205 |

| Avg Vol (10 day): | 108,867 |

| Shares Outstanding: | 9.32M |

| Float: | 7.70M |

| % Held by Insiders: | 4.45% |

| % Held by Institutions: | 16.90% |

| Shares Short (as of Jan 31, 2013): | 1.27M |

| Short Ratio (as of Jan 31, 2013): | 6.30 |

| Short % of Float (as of Jan 31, 2013): | 15.70% |

| Shares Short (prior month): | 1.18M |

The company has a low float with a healthy short interest, which is something I always like to see in a stock. Too many shares short signals too many bears and potentially bad issues with the company, too small short interest often means a stock that could be overbought.

With the high barriers to entry in a very complex field, Cyclacel looks to be undervalued with a market cap of only $52M. Comparatively, Sunesis Pharma (SNSS) has a market cap of $275M - more than 5 times the market cap of Cyclacel.

Sunesis' drug candidate vosaroxin, also designed to treat AML, is currently undergoing a Phase III study in patients with relapsed or refractory AML.

Sunesis, like Cyclacel, was under the radar for some time causing it to be very undervalued. On May 9th, 2012, I wrote an article featuring Sunesis when the stock was trading around $2.70. Today, Sunesis trades for around $5.35. The comparison above is not meant to spark a debate which drug or company is better, but rather to show the investment opportunity Cyclacel may provide, and to show that it is very undervalued. Having said that, vosaroxin will not be a frontline drug, where sapacitabine likely will be, which equates to more money potential for sapacitabine.

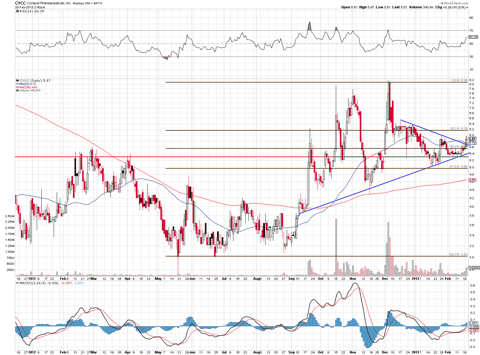

The chart has been in an uptrend and after forming a wedge, it looks to be set to break out again, especially when we look at the last candle for yesterday's trading session. The first price level to watch is $6.16-$6.20, and then a test of the highs in the $8s could be in range.

In my opinion, Cyclacel might be one of the most undervalued speculation investments around. The data so far looks promising, and more data is expected by the end of the current quarter.

FDA approval of any of its pipelined drugs could see a stock price 5 times its current value, which would still result in a market cap less than Sunesis' current valuation. If the data continues to be positive for sapacitabine, a one year target of $15 to $20 is within reach for Cyclacel.

I am long $CYCC

http://stockmatusow.com/disclaimer/

*Data sourced from Nasdaq.com.

**Data sourced from Yahoo Finance.