To begin this week, I list four biopharma companies I feel have significant catalysts coming up.

According to investinganswers.com a catalyst is defined as news or information that changes a pricing trend in a security.

Catalysts can drive an investment up or down. A favorable event can push a stock to new heights, but if events turn sour, the exit for these shares can be very narrow and very crowded.

Let's take the example of a classic investment catalyst: adverse press publicity. A fundamentally strong company can get unfairly beaten up by the press and by analysts, driving down its stock price to unjustified lows. In this case, the catalyst would signal a great opportunity for investors to buy, not sell.

Catalysts can change the perception of a security. They can be almost anything: earnings releases, favorable or unfavorable economic reports, management changes, new products, product recalls, successful (or unsuccessful) marketing campaigns, lawsuits, etc.

Quite often, catalysts are the news or events that finally call attention to fundamentals or other intrinsic factors that have existed for some time in a security. When investors can identify what events or information will be catalysts for a particular security, they essentially are able to predict which way the security will go if and when the information becomes public knowledge.

In biopharma, catalyst events include, but are not limited to, events such as anticipated drug approvals, clinical study data releases, New Drug Application (NDA) filings, and anticipated partnership deals.

Let's take a look at the 4 companies with significant catalysts coming up.

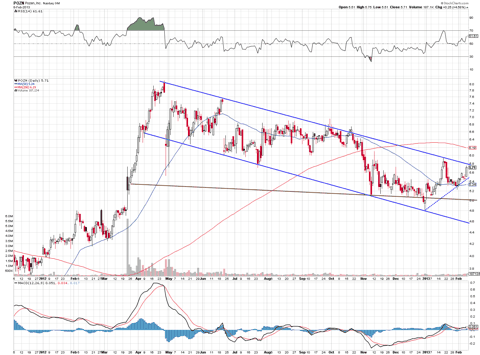

Pozen (POZN)

Pozen plans on filing an NDA in April for PA32540, which according to Pozen's website:

PA32540 is a coordinated-delivery tablet combining immediate-release omeprazole (40 mg), a proton pump inhibitor (PPI), layered around pH-sensitive enteric-coated aspirin (325 mg). This novel, patented product candidate is administered orally once a day and will be indicated for use for the secondary prevention of cardiovascular disease in patients at risk for aspirin-associated gastric ulcers. Pozen has completed two pivotal Phase III trials, and a long-term, open-label safety trial for secondary cardiovascular disease prevention was completed in 2011. Top-line results were announced in March 2012 and presented at both ACG and AHA in October and November 2012, respectively.

The company has also clearly indicated that it wants a partnership deal in place before it files the NDA in April, which is an additional significant catalyst.

Some analysts believe that this particular PA drug could be a $400M global opportunity for the company. I agree, and also feel the potential for other products in the company's pipeline add additional speculation value.

The chart indicates that the stock might be poised to make another run near its 52-week high of $8.12. This is a strong chart in my opinion and set up to move much higher.

The near term NDA filing plus any announcement of a partnership deal beforehand for this particular PA drug should see the stock rally significantly.

Aeterna Zentaris (AEZS)

Interim results are expected this quarter for the company's much maligned drug, Perifosine, which is being studied for the treatment of multiple myeloma. An independent committee will analyze the results and give a recommendation whether or not the company should continue development of the drug or not.

On April 2nd, 2012, Keryx Pharma (KERX) announced that Perifosine failed its Phase III trial for the treatment of colon cancer. Keryx licensed Perifosine from Aeterna, and after the failure, returned the drug back to Aeterna. Since then, both companies have gone in opposite directions. Keryx recently announced positive data for its Phase III drug Zerenex, designed to treat chronic kidney disease. Keryx recently hit a 52 week high of $9.98 on January 31st. On a side note, investors might want to take a hard look at Keryx moving forward. Keryx could end up being a great success story in the making for some time to come.

For Aeterna however, after the Perifosine failure its shares plummeted to a 52 week low of $1.75 (adjusted from a 1:6 reverse split, actual 52 week low was $0.29). The company had to engage in a reverse split and financing just to stay afloat.

The chances for Perifisone success in treating multiple myeloma might not be good. In its failed Phase III for colon cancer, Overall Survivablity (OS) saw no real improvement from baseline. However, since multiple myeloma is an entirely different form of cancer, there does remain an outside chance that the drug may be able to improve OS.

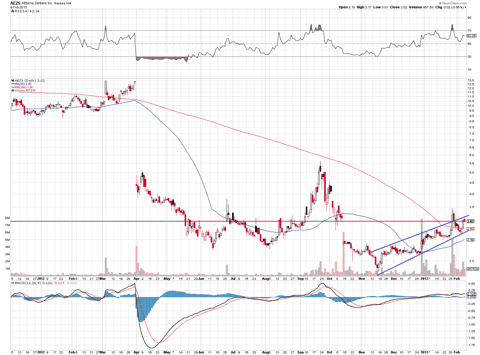

Is there hope this time around for Perifosine? Can Aeterna be a turnaround story like its former partner Keryx? Yes, there is some hope and the chart indicates that many investors seem to think so.

After being beaten down for some time, the stock is looking to turn the corner and rebound. An uptrend channel has been forming leading into the anticipated data results. I expect this trend to continue as it begins to trade near its older range prior to the second gap down shown in the chart above.

A green light for Aeterna to move forward with Perifosine would be major good news for the company, but a recommendation from the independent committee to end the drug's trial would result in a devastating blow that the company would have a hard time recovering from. The chart above does seem to indicate that traders are buying Aeterna, so I do expect the stock to see some short term upside gain before the catalyst event here. However, please use caution with this trade since negative news would mean a stock price collapse as mentioned above.

Ziopharm Oncology (ZIOP)

Results from the company's Palifosfamide phase III study for the treatment of Soft Tissue Sarcoma (STS) are expected at the end of the current quarter.

Palifosfamide belongs to a group of chemotherapy drugs called alkylating agents, which halt tumor growth by binding to cancer cell DNA and interfering with its function. Alkylating agents have demonstrated activity in a wide range of solid tumors and hematologic cancer. Palifosfamide was rationally designed to confer similar efficacy compared to in-class agents, with significantly improved tolerability.

Palifosfamide has shown promise as a treatment for cancers with increased levels of aldehyde dehydrogenase (ALDH), an enzyme though to confer cancer stem cell-like activity and therefore resistance to treatment, particularly treatment with alkylating agents. High levels of ALDH have also been associated with worse prognoses and poor clinical outcomes in cancer patients.

If the data release is positive for Palifosfamide, the stock would rally massively. Any treatment that is shown to successfully treat sarcomas is a huge deal.

What are the chances here of a positive Phase III result? Well, according to Adam Feuerstein, roughly 17% using his "Feuerstein-Ratain Rule." According to Adam:

First, a reminder about the Feuerstein-Ratain (F-R) Rule: University of Chicago oncologist and professor Dr. Mark Ratain and I examined 59 phase III clinical trials of cancer drugs going back 10 years. We found companies with micro-cap market valuations (i.e. market caps less than $300 million) had no chance -- 0% -- of producing positive phase III results.

Adam goes on to make a good point about his rule:

The logic behind the F-R Rule borrows a bit from Occam's Razor. Good cancer drugs are scarce and valuable commodities, and potential Big Pharma partners and institutional investors are forever scouting for opportunities to buy, license or invest in companies with drugs that have a high probability of success. Said another way, there are very few, if any, cancer drugs that come out of nowhere to be big sellers.

The above is solid logic, but as we get closer to Obamacare being enacted in full, along with the 2011 directive issued by the Obama Administration to the FDA, I feel we will see more smaller biopharmas begin to break Adam's and Dr. Ratain's rule trend. Also, the understanding of the molecular biology of cancer and how to administer chemotherapy has improved over time. Researchers are gaining more knowledge on how to separate clinical benefit from toxicity which can have a positive impact on the quality of life for those suffering from the disease.

Drugs like Palifosfamide could be considered next generation chemotherapies, so Palifosfamide could end up showing a benefit in that sense.

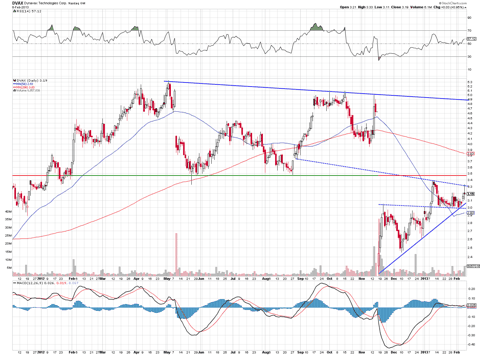

Let's take a look at the chart to gauge how investors are feeling about ZIOP's stock:

After a significant fall, the stock has found support at the $3.80 level, which looks to be a launching point to propel the stock back to the $4.75 resistance area. The rounding pattern seen above that it is forming in the chart above certainly seems to supports this.

Dynavax Technologies (DVAX) is expecting a Prescription Drug User Fee Act (PDUFA) date of February 24th for its hepatitis B vaccine Heplisav. Basically, this means the FDA will decide on or before this date whether or not to approve the drug.

Hepatitis B is an infectious inflammatory illness of the liver caused by the hepatitis B virus (HBV). The disease has caused epidemics in parts of Asia and Africa, and it is endemic in China. About a third of the world population has been infected at one point in their lives, including 350 million who are chronic carriers.

Needless to say, the market is large for a drug like Heplisav. Many biotech analysts and writers believe the drug will be approved. The real question is whether or not the FDA will place certain restrictions on the drug, such as patient age and dosing restrictions. Also worth considering is last November's advisory committee safety vote on the drug, which was 5-8 against. This prompted Jeffries to lower its price target from $6 to $5, with the analyst firm still rating the stock a "buy."

However, the negative safety vote likely will not dissuade the FDA from approving the drug -- with tighter label restrictions.

Let's take a look at the chart to get an indication on where Dynavax's price might be heading towards:

After the company received the 5-8 safety vote against Heplisav, the stock took a beating but now appears to be making a nice come back. If the stock moves past its last resistance trendline point, it should test $3.45 with no issues. If the price can break the $3.45 range on volume, it could fill the huge gap left from when the stock plummeted before.