Zogenix (ZGNX) engages in the development and commercialization of products for the treatment of central nervous system disorders and pain. Its commercial product includes Sumavel DosePro (sumatriptan injection), a delivery system that offers needle-free subcutaneous administration of sumatriptan for the acute treatment of migraine and cluster headache. The company's lead product candidate, Zohydro, is a single-entity extended-release hydrocodone, which has completed Phase III clinical trials for the treatment of moderate to severe chronic pain requiring around-the-clock opioid therapy.

Zogenix is facing an FDA Advisory Committee meeting for its drug, Zohydro ER (hydrocodone bitartrate extended-release capsules) on December 7, 2012; with an assigned PDUFA date of March 1, 2013

Zohydro ER could be the first hydrocodone product to offer the benefit of less frequent dosing and the ability to treat chronic pain patients without the risk of liver injury associated with the use of acetaminophen in high dosages or over long periods of time. Zohydro ER would also be the first long-acting hydrocodone based solution that is not combined with another pain-relieving drug. Currently, hydrocodone is only available in immediate-release, combination products, most commonly with the prior mentioned analgesic acetaminophen. These products require dosing every 4 to 6 hours.

In early September, Endo Health Solutions (ENDP) announced that a subsidiary issued a voluntary recall for one lot of its hydrocodone bitartrate and acetaminophen tablets, saying it's possible that some tablets exceed the weight specification and could be super-potent. The increased acetaminophen content could result in liver toxicity, especially in patients on other medications containing acetaminophen, patients with liver dysfunction, or people who consume more than 3 alcoholic beverages a day. Endo's drug here clearly had an issue with liver toxicity as I mentioned prior as a concern with acetaminophen. This is all the more reason I feel Zohydro could be a potential large revenue generator for the company.

Zalicus Inc. (ZLCS) announced on August 27th that the FDA approved the supplemental new drug application (SNDA) filed by Mallinckrodt Inc., a subsidiary of Covidien plc, for the 32 mg dose strength of Exalgo (hydromorphone HCl) Extended-Release Tablets. This drug is for the management of moderate to severe pain in patients requiring continuous, around-the-clock opioid analgesia for an extended period of time. Exalgo provides time release of hydromorphone throughout the day once a steady-state is achieved after three to four days. I like Zalcius's pain killing solution here, but unfortunately for the company, it receives a very small royalty from Covidien. Both Zohydro and Exalgo represent a time released solution for patients with pain who are opioid-tolerant.

Existing hydrocodone-containing pain relievers generate about $3.5 billion in U.S. sales. Even taking a small slice of this large market, Zohydro's sales could reach $500M to $800M in my estimation, if ultimately approved by the FDA.

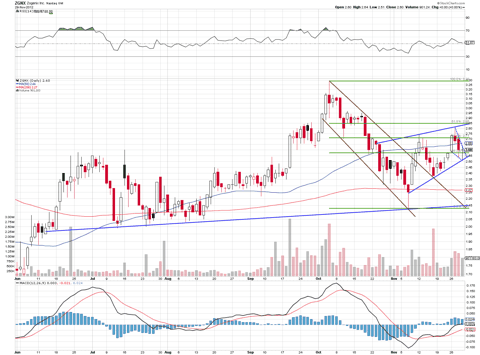

The chart above shows that the stock has strong mid-term up trend support and is currently in a near term up channel making higher highs and higher lows. The price should at least touch $2.85 (the 61.8% retrace point and up channel resistance), and a move over $3 is within reach as traders anticipate this Friday's FDA's Advisory Committee (Adcomm) meeting in which committee members will vote whether or not to recommend Zohydro for approval.

Cyclacel Pharma (CYCC) engages in developing oral therapies that target the various phases of cell cycle control for the treatment of cancer and other serious diseases. Its core area of expertise is in cell cycle biology where the company focuses primarily on the development of orally-available anticancer agents that target the cell cycle with the aim of slowing progression or shrinking the size of tumors. In addition, the company looks to enhance the quality of life while improving survival rates of cancer patients. Cyclacel's lead drug candidate is Sapacitabine, a drug undergoing research for potential use in treating blood and other types of cancers. The company's other product is Seliciclib (CYC202), a CDK (cyclin dependent kinase) inhibitor that is in a Phase IIb clinical trial for the treatment of NSCLC. The drug is also in Phase II clinical trials to treat nasopharyngeal cancer as well as Phase I clinical trials in combination with Sapacitabine to treat cancer.

Sapacitabine is an oral nucleoside analog pro-drug that acts through a dual mechanism. I find this oral dosing to be a big benefit if proven effective as most everyone understands the terrible side effects common from typical chemotherapy and other cancer treatments. The compound interferes with DNA synthesis by causing single-strand DNA breaks and induces arrest of the cell division cycle at the G2 phase.

Sapacitabine has demonstrated potent anti-tumor activity in both blood and solid tumors in preclinical studies. In a liver metastatic mouse model, Sapacitabine was shown to be superior to Gemcitabine (marketed as Gemzar by Eli Lilly (LLY)) in delaying the onset and growth of liver metastasis.

Sapacitabine oral capsules are currently involved in the following:

- The SEAMLESS Phase III trial being conducted under a special protocol assessment with the FDA as front-line treatment of acute myeloid leukemia (AML) in the elderly.

- Phase II studies for myelodysplastic syndromes (MDS) and solid tumors including lung cancer.

- Investigator-led studies such as a Phase II/III comparing sapacitabine to low dose cytarabine as front-line treatment of elderly patients with AML or high risk MDS unfit for intensive chemotherapy, and a Phase II study in chronic lymphocytic leukemia.

In an October 15th press release, Cyclacel announced positive Phase II study results from Sapacitabine. The company reported that the drug nearly doubled the expected survival rate in elderly patients with MDS after front-line therapy failure. One of these front-line treatment examples is Azacitidine, marketed as Vidaza by Celgene (CELG). I looked at what the sales were for Vidaza since it can demonstrate the opportunities out there for Cyclacel. In the third quarter alone, Vidaza reportedly had sales of $220 million, which obviously translates to close to a billion dollars when averaged out over the course of an entire year. Another example of a front line treatment is Dacogen from Astex Pharmaceuticals (ASTX).

Prior to the press release, the data was discussed at The Eighth Annual Hematologic Malignancies 2012 Conference being held on October 10-14, 2012, in Houston, Texas. Median overall survival to date for all 63 patients in the Phase II study is 252 days or approximately 8 months. Median overall survival for 41 out of 63 patients with 10% or more blasts in their bone marrow is 274 days or approximately 9 months.

Median survival for patients with intermediate-2 or high-risk disease, as defined by the International Prognostic Scoring System (IPSS), is 4.3 to 5.6 months.

I thought The Life Sciences Report (TLSR) had an excellent interview with John McCamant, (JM) editor of the Medical Technology Stock Letter. During this interview, questions were raised related to blood cancers and potential investments in this area as well as highlighting this landscape as an unmet medical need.

John believes MDS and AML represent nice opportunities for investors. One exchange from the interview in particular between John (JM) and The Life Sciences Report (TLSR) highlights Cyclacel from a valuation perspective and related to the press release I mentioned earlier:

TLSR: We just got some news from Cyclacel. It announced data in an ongoing Phase II trial with sapacitabine for older patients with MDS who had failed azacitidine and/or decitabine. Expected survival rates were doubled. What is your opinion on this study?

JM: We looked at some of the data, and the data looks solid, particularly with the Phase III trial ongoing in AML. That makes a difference for us. The key is the larger Phase III trial with AML: The potential gives the Street and analysts a little more confidence. The Phase II MDS trial does not use a placebo as the control arm, as it would be unethical to not use standard-of-care in elderly and frail patients. We also know that other trials are coming, using the Cyclacel compound in similar cancers. The data have been good to date, and the stock has responded nicely. We look forward to viewing the Phase III data in AML.

TLSR: Do you cover Cyclacel in your newsletter?

JM: No, but we've followed Cyclacel over the years. Frankly, it has been slow in development, but things seem to be accelerating, and the valuation looks pretty attractive right now. The company is a little low on cash, so we would not be surprised to see it trying to raise some capital. Also, it does not yet have a partner, which would help validate the technology. But it has a pretty good development team and a very nice pedigree, with Christopher Henney, a co-founder of Dendreon Corp. (DNDN) and Immunex Corp. (acquired by Amgen (AMGN) for $16 billion in 2002), as a board member. We're going to do a little more homework on Cyclacel. We are trying to sit down with management and get its take on what's going on as the company moves forward.

TLSR: Because of the recent data, Cyclacel's stock is up sharply over the last month. However, even with its performance, the company only has a $46 million ($46M) market cap.

JM: That's the key number. We can talk about share prices and all these other numbers, but that market cap really dials us in. For a Phase III cancer company, that's an unusual valuation. The recent price rise probably increases the odds that the company can go out and raise some money. But Wall Street is skeptical when it comes to unpartnered small biotech companies. It is hard for these types of companies to gain traction or get any visibility. At the end of the day, if Cyclacel keeps doing its job and delivering good data, valuation will take care of itself.

TLSR: Can you speak to Astex Pharmaceuticals (formerly SuperGen Inc.)? It is also heavily involved in the heme/onc space.

JM: Astex is a different type of company. It has been around for quite some time under a different name. It made a good move when it merged with a British company and acquired a platform technology. Now Astex appears to be making some moves forward in the heme/onc space. That being said, we're looking at a much different valuation.

TLSR: A $276M market cap, right?

JM: The market cap is five times that of Cyclacel. But Astex has an approved MDS product, Dacogen (decitabine), and it generates some revenue with that product. Management is solid. Generally, investors want an exciting molecule rather than a revenue-producing, older cancer drug. It can be difficult running two different companies at the same time-one having a sales organization out there marketing, and the other focusing on research and development. It is a lot for a smaller company to manage effectively.

TLSR: Dacogen is a DNA methyltransferase inhibitor used in MDS and AML. If Cyclacel gets sapacitabine approved for those indications, how much would that eat into Dacogen revenues?

JM: Quite possibly a good bit, because we are talking about a novel oral compound from Cyclacel. Safety is more important in these elderly patients, but efficacy is needed.

TLSR: Would you consider following Astex in your newsletter?

JM: We have been tracking it off and on. We've known the company as SuperGen, from back in the day. But we have learned to never say never. The acquisition of Astex Pharmaceuticals (the British company mentioned above; SuperGen changed its name to Astex following the merger), with its discovery platform, is intriguing to us. It looks like the lead molecules make sense and are in the right cancer space. But the company has a different valuation than Cyclacel. We'll do some work here, but it looks like the more exciting molecule might be at Cyclacel.

I think the above speaks rather clearly on the potential Cyclacel offers here. However, as with most small cap biopharmas, there is no guarantee of success -- with larger risk comes larger reward, and I think Cyclacel might offer such a reward for those willing to take the longer term buy and hold risk.

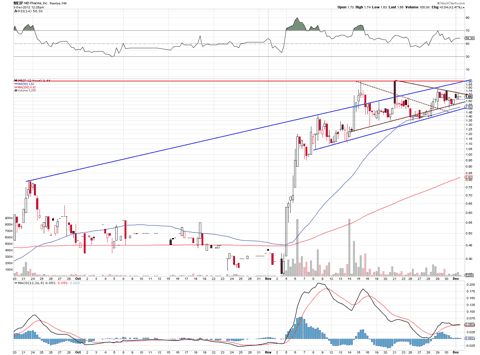

The chart above shows the stock is sitting between the 50% and 61.8% retrace points after coming down from a very strong up channel. It now appears to have found new footing with a new uptrend line. I believe the stock is poised to test the $6.50 level soon, after yesterday's big move up.

MEI Pharma (MEIP)

MEI focuses on the clinical development of therapeutics for the treatment of cancer. It develops various lead drug candidates, including ME-143 that has completed Phase I clinical trials in patients with refractory solid tumors; ME-344, an active metabolite of NV-128, which is in Phase I clinical trials in patients with solid refractory tumors; and Pracinostat, an orally histone deacetylase inhibitor that has completed various Phase I clinical trials in patients with hematologic disorders.

On 11/6/12, the company announced it will be presenting data on Pracinostat, in combination with Azacitidine in patients with advanced myelodysplastic syndrome at a poster presentation at the American Society of Hematology Annual Meeting on December 10, 2012.

The company also recently announced that its lead mitochondrial inhibitor drug candidate, ME-344, has been named one of the Top 10 most licensable oncology products to watch for in 2012 by Elsevier Business Intelligence and Campbell Alliance.

MEI has some interesting things going on for it, the most important being the poster presentation coming up on Monday, December 10th, at 6 PM eastern time.

An abstract of the presentation, entitled, "Very high rates of clinical and cytogenetic response with the combination of the histone deacetylase inhibitor Pracinostat (SB939) and 5-azacitidine in high-risk myelodysplastic syndrome," submitted by Dr. Quintas-Cardama and Dr. Garcia-Manero of the MD Anderson Cancer Center, is available online at www.hematology.org.

Pracinostat has been tested in more than 150 patients in multiple Phase I and signal-seeking Phase II clinical trials and found to be generally well tolerated with readily manageable side effects often associated with drugs of this class, including fatigue. The results of these studies suggest that Pracinostat has potential best-in-class pharmacokinetic properties when compared to other oral HDAC inhibitors.

Pracinostat has demonstrated clinical evidence of single-agent activity, including studies in patients with advanced hematologic disorders such as acute myeloid leukemia and myelodysplastic syndrome. The results of these studies were presented at the 2010 American Society of Hematology Annual Meeting. In addition, data from a Phase II clinical trial of oral Pracinostat showed activity in heavily pre-treated patients with intermediate or high-risk myelofibrosis, with two patients showing a clinical improvement. These results were published in the September 2012 issue of Leukemia Research.

Pracinostat has also shown evidence of activity when used in combination with a wide range of therapies in clinical and pre-clinical studies. Recently published pre-clinical data in the May 2012 issue of Blood Cancer Journal demonstrated synergistic activity when Pracinostat was combined with Pacritinib, an experimental Janus kinase 2 (JAK2) inhibitor.

Daniel P. Gold, Ph.D., President and Chief Executive Officer of MEI Pharma remarked;

We are very encouraged not only by the response rates reported to date, but also by the rapid appearance of the responses with the combination of Pracinostat and Azacitidine. These data are particularly compelling given that most patients in the study had treatment-related MDS and expressed high-risk cytogenetic abnormalities, both of which carry a poor prognosis. With these data in hand, combined with the capital raise we announced yesterday [11/5/12], we expect to be in a position to rapidly advance to the next stage of development and initiate a randomized Phase II trial of Pracinostat in combination with Azacitidine in patients with MDS by the second quarter of next year.

The American Society of Hematology Annual Meeting is sure to get MEI some coverage here, and potentially positive data could rally the stock significantly higher than its current price level. Therefore, I bought some shares of it as a catalyst trade.

The stock appears to consolidating in a pennant, which indicates it can make another nice run. It hasn't gone parabolic yet, and it still remains in a nice up channel. I would expect volume to pick up as the company nears the 12/10/12 trade catalyst event, with a move in the stock to around $2.25.

Disclosure: No Position

Disclaimer: This article is intended for informational and entertainment use only, and should not be construed as professional investment advice. They are my opinions only. Trading stocks is risky -- always be sure to know and understand your risk tolerance. You can incur substantial financial losses in any trade or investment. Always do your own due diligence before buying and selling any stock, and/or consult with a licensed financial adviser.

I’m still holding zlcs from.98.